26 Bright Business Savings Ideas for SMBs

What's Inside?

Use this table of contents to skip ahead to any chapter.

Chapter 1

Saving is More Important than Ever

Chapter 2

Creating a Company-Wide Savings Culture

Chapter 3

4-Step Process to Save Your Business

Chapter 4

6 Savings Areas to Evaluate

Bright Savings Ideas:

People

Bright Savings Ideas:

Marketing & Sales

Bright Savings Ideas:

Technology

Bright Savings Ideas:

Purchasing

Bright Savings Ideas:

Infrastructure & Operations

Bright Savings Ideas:

Energy

Savings Right Above Your Head

FES: A Saving Partner for Life

Businesses have become all too familiar with cutting costs and making substantial changes this year.

While cost efficiency always makes smart business sense, it’s become a matter of survival for many small business owners.

The COVID-19 pandemic has accelerated the need for belt-tightening and thinking creatively about where you invest every dollar. You’re likely dealing with extra expenses around new health and safety protocols, but facing lower than expected earnings.

In this tumultuous climate, most businesses aren’t able to control sales or profit margins. This means that saving money is one of the only things you can control. Reducing expenses will ultimately protect the long term health of your business.

Creating a smart savings strategy will help you free-up dollars to invest in other areas that are core to your business -- like marketing and sales, the right talent, and new technologies that you’ll need today and for the future.

This eBook covers creative steps you can take to reduce expenses, short-, mid- and long-term.

You’ll discover:

- A 4-step process to ensure you have a smart savings strategy

- How to make cost efficiency part of your company culture

- 25 key areas that small businesses can reduce expenses

- The role energy plays in business expenses and how you can stop it from decreasing your company’s profitability

Quick Tips to Maximize Savings

Prioritize changes that will add immediate value.

Some of the energy savings tips not only unlock instant savings, but also come with cash rebates.

Address the low-hanging fruit first.

Look for uncomplicated improvements with low dependencies.

Identify creative savings opportunities.

If you can save money and create a healthier environment, the dividends can pay off.

3 Bright Ideas You Don’t Want to Miss

Infrastructure & Operations Management

Many companies have had to rethink their physical locations. Getting creative in this area can unlock surprising savings.

Employee Management

Businesses can save over $10,000 each year for every employee they let work from home.

Switch to LED lighting.

You can reduce your electricity bill by about 60% when you switch to LED. Some energy companies will even cover the cost of the lights.

The COVID-19 pandemic has taken a bite out of even the healthiest bottom lines. Most industries have experienced a drop-off in sales

Many small retailers are closing up shop. Travel is down. Hotel rooms are empty. Restaurants are running at half-capacity, if they’re able to offer service at all. Consumers are holding back on major spending and radically changing their purchasing habits.

Businesses are looking for ways to fund new initiatives and change-up their offerings to meet today’s needs. Some industries are prospering, but even in good times saving for the future is critical.

Disaster relief programs have helped many SMBs and big companies weather the financial storm. Even if you’ve gotten that much-needed cash infusion, you need to make every dollar count.

Smart businesses are mapping out cost-savings plans that will carry them through the challenging road ahead, as uncertain as it may be.

In fact, business spending is expected to decrease by 10-20% in 20201.

But where should those savings come from? And how do you begin?

Start by identifying a savings champion who can rally your team together. If you’re a small business owner, this is probably you. For a bigger company, it may be the CEO, CFO or Controller.

Then bring everyone into the loop. Your team is more likely to commit to a cost-saving effort if they are part of the process. Explain to your team leaders that deliberate and growth-oriented spending needs to become part of your company’s mission and values. If managers and employees understand that you’re not just “slashing and burning” expenses, but are protecting everyone’s jobs, they will respect and engage in the process.

According to experts, bringing your team (including outside advisors) into the cost-saving process will ensure buy-in and faster action.

"Involving employees in the decision-making process not only empowers them to contribute to the success of an organization but also saves the company time and money in increased productivity and reduced outsourcing."

Casey Anderson, Chron

Traits of a Savings Culture

Every business, regardless of size, has expenses that haven’t been examined for months or even years. The key to meaningful cost savings is understanding which of those costs are business-critical and which will go unnoticed by customers and employees.

Choose the right team.

Many companies have had to furlough or let go of team members. As you think about your team, make sure you have talent on board who can shape your future. Naysayers or those who are wedded to “the way we’ve always done it” will not necessarily help you change how you’re spending your valuable dollars. Great ideas can come from anywhere. Listen to everyone -- at every level.

Create an expense review process.

for examining expenses that’s enjoyable and inclusive. If you build a spirit of teamwork and creativity, saving money becomes a challenge. Reward people for great ideas and celebrate successes. Over time, employees will encourage each other to take cost-savings actions. For example, successful businesses train their employees on the significant impact of energy savings.

Measure results.

Set specific cost-reduction goals and report on them regularly. Reporting systems should be simple and focus on the most significant opportunity areas. Just as you share sales results, broadcast meaningful cost savings successes.

Get outside advice.

Engage third-party partners and suppliers who can help you objectively analyze expenses and provide case studies and perspectives from their other clients. The right vendors and service providers don’t just cost you money; they can help you save it.

Every business spends (and saves) money differently. Where you cut spending could have a substantial long-term impact on your company’s bottom line.

There are six main areas of your business where you can look for savings. Some of these may already be on your list, but there are likely a couple that you haven’t thought of yet.

1. People

2. Marketing & Sales

3. Technology

4. Purchasing

5. Infrastructure & Operations

6. Energy

Bright Saving Ideas:

People

Payroll and benefits expenses can be significant, reportedly taking up as much as 70% of company budgets2. It’s often the first area that companies look to reduce costs. However, eliminating the wrong positions can significantly affect customer service and morale. Cutting staff isn’t the only way to reduce your payroll and human resources costs.

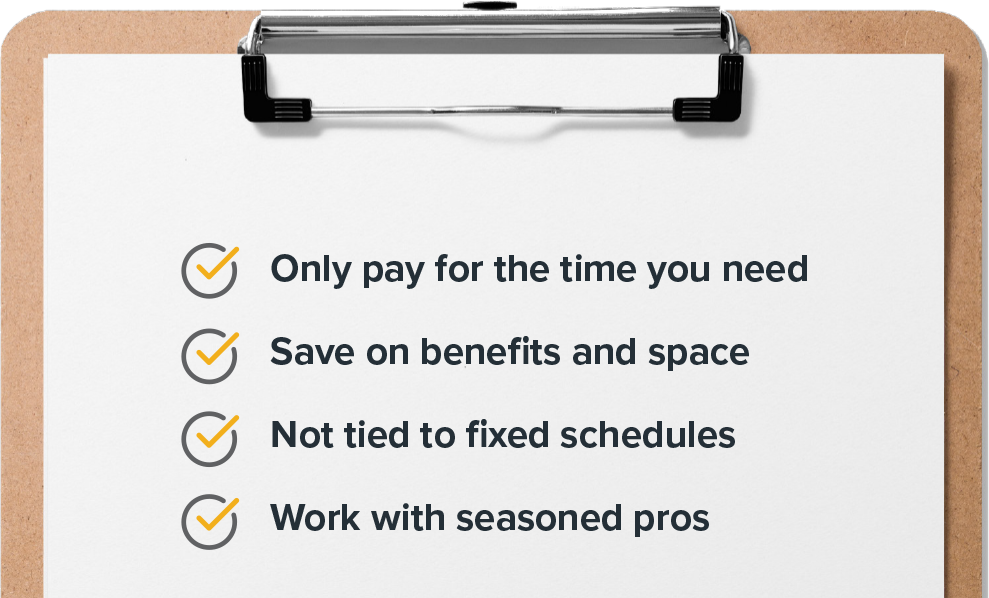

Bright Idea #1

Outsource functions or hire part-time or freelance employees.

When you engage people outside your organization, you only pay for tasks or time when you need them. Plus, you can gain broad and deep expertise from seasoned professionals who choose to work for themselves rather than in-house. You save on benefits, space, and even on time. Freelancers and contractors are often willing to work hours that employees may not.

Outsourced Team

Flexible Team

Bright Idea #2

Rethink work hours and overtime.

Track your peak periods and make sure your staffing matches up to them. This isn’t a “set it and forget it” exercise. Chances are that your traffic flow has changed drastically this year, and will continue to do so. You may be operating under restricted hours. And people’s buying habits are certainly different. Be sure that you’re regularly evaluating your peak hours so you can take an agile approach to scheduling.

Bright Idea #3

Invest in time tracking software.

Track your peak periods and make sure your staffing matches up to them. This isn’t a “set it and forget it” exercise. Chances are that your traffic flow has changed drastically this year, and will continue to do so.

You may be operating under restricted hours. And people’s buying habits are certainly different. Be sure that you’re regularly evaluating your peak hours so you can take an agile approach to scheduling.

Bright Idea #4

Keep critical perks, but choose wisely.

Bright Savings Ideas:

Marketing & Sales

These are usually fair game in expense-cutting decisions. According to Spendesk3, 63% of financial leaders are most likely to cut marketing and sales expenses during a crisis.

Before you go chopping away at the tactics that help keep revenue coming in the door, remember this. As the Great Depression showed, companies that invest in their brands have a higher chance of survival. Now is a great time to innovate and focus on building your business, and improving relationships with your customers.

Bright Idea #5

Switch from paper to electronic communications.

Companies are going paperless, especially in an era where we’re limiting human contact. Many consumers prefer digital communications. Contracts, instruction guides, invoices and other paper-based communications can convert to electronic media or print-on-demand technology.

Paperless communication is:

- Cheaper for your business

- Quicker to access

- Healthier for your team and customers

- Better for the environment

"In a year, the average employee prints 8,874 pages, and 17% of them will go unread.”

Impact

Think before you print.

That applies to internal printing as well. The average employee prints 10,000 pages each year. It averages out to a yearly cost of about $725 per employee. And 17% of those pages are never even read.

How much is printing costing you?

10,000

$725

17%

Bright Idea #6

Look to current customers for new business sources.

People who know and like your business are the best source of new customers.

Focus on keeping your existing customers happy. The cost of replacing them is significantly higher than the cost of retaining them. And they’re often the biggest advocates of your business.

81%

Loyalty program

Consider creating a loyalty program to reward customers for their repeat business.

Referral program

Offer your customers incentives for referring their friends and family members. We actually offer a $500 bonus for customers or the public who refer businesses to FES.

Bright Idea #7

Automate and streamline your e-mail marketing.

It’s not enough to deliver a great experience at the time of service. You need to stay connected with your customers even when they’re making a purchase.

If you’re not using an e-mail marketing tool that lets you send automated emails to customers based on individual attributes, you may want to consider it. This will save you time and effort in the long run because you can market with precision. This graphic overview of what an SMB should have in its “tech stack” is useful to all types of businesses.

"No matter what your small business is up against, there’s bound to be a technology solution.”

Vidyard

Bright Savings Ideas:

Technology

As the retail, restaurant, real estate, and event industries are discovering, having the right automation solutions can be a key to survival. Make sure you’re buying the right solutions that can save -- and make -- money.

- The average SMB spends $10,000 to $49,000 on technology each year8

- 52% of small business owners feel they spend too little on technology

- 22% feel they are spending too much

- 44% feel they are spending the right amount

Bright Idea #8

Research which technologies other businesses like yours are using.

Bright Idea #9

Evaluate leasing options.

Purchasing your equipment outright isn’t always the right way to go. You may want to consider leasing more expensive technology or equipment.

Business News Daily offers a great guide for business owners to navigate the ins and outs of leasing equipment.

There are several benefits to leasing equipment:

Low up front investment

Pay over time

Easily upgrade equipment when newer options are available.

Bright Idea #10

Consider buying used equipment -- but know what you’re buying.

One company’s excess inventory can be another company’s treasure. From refurbished computers or copy machines to used appliances or restaurant equipment, buying used can save you thousands of dollars. This can be especially helpful if you’re transitioning to a remote work force and need to provide your team members with laptops or other technology to work from home.

Be sure that the equipment you’re buying is easy to maintain and upgrade. The Small Business Administration offers some tips. You can also search for advice related specifically to your industry or type of equipment you need.

Bright Idea #11

Invest in automation that eliminates labor-intensive processes.

Inefficiencies abound in all types of businesses. As you work with your team on cost-saving ideas, find out where they are spending the most time. Chances are, there’s a tool available today to automate parts of those highly manual processes.

People sometimes get concerned about the idea of automation. This is where it’s important to approach these changes from the perspective of making your team member’s lives easier and freeing up their time to focus on more important areas that can’t be automated.

Bright Idea #12

Consider bartering.

Bright Idea #13

Create a buying co-op with other SMBs.

Bright Idea #14

Don’t just buy, sell!

Bright Idea #15

Negotiate discounts.

Buyers can often negotiate discounts for early payment or paying in advance annually for necessary services. Talk to every vendor you currently use about what savings options they offer.

Bright Idea #16

Shop around for credit lines.

Make sure your business credit cards have the best rates and perks. How you’re managing your money can be as important as how you’re spending it. Bank fees are another line item that can add up. Do a thorough audit of what you paid last year in fees and interest and commit to reducing that number.

Bright Idea #17

Comparison shop.

Bright Idea #18

Look at your workspace.

As working from home (WFH) becomes more mainstream, some companies are rethinking their building spaces. Many businesses are transitioning to virtual or downsizing locations.

If you have flexibility in terms of where your business is located, look to lower-rent areas when your lease is up. Opportunity zones offer significant incentives for companies willing to locate in up-and-coming neighborhoods.

Before you move on, try to negotiate your current lease terms. Even property management companies are struggling. Many landlords will provide some financial assistance in order to keep tenants in place.

Bright Idea #19

Offer remote work options.

Depending on the nature of your business, some team members might not necessarily need to be onsite all the time. Allowing employees to work from home can save energy costs, result in greater employee satisfaction and allow employees to be more productive.

Fundera estimates that businesses save $11,000 each year for every employee they allow to work from home at least part of the time.9

Bright Idea #20

Invest wisely in health and wellness.

Keeping your place of business clean is no longer an option -- it’s a legal requirement and public safety necessity. This isn’t necessarily an area to bargain-shop, but know your facts before investing in new cleaning products, systems and touchless equipment. Co-op buying and contract negotiation can save you money on necessary expenditures.

Bright Idea #21

Make updates while people are away.

If your business is facing temporary closures, it can be a great time to complete repairs or upgrades that can help you save money in the future. Consider making updates that you’ve never had the ability to get to with a full staff on your property, like making repairs on inefficient machinery.

Bright Savings Ideas:

Energy

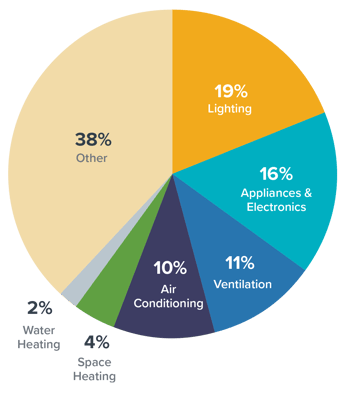

Energy -- heating, cooling, and lighting -- is an often-overlooked element of infrastructure expenses that can cost businesses tens of thousands of dollars each year. Chances are, even if your revenue is down your energy costs haven’t changed much. Energy accounts for $60 billion10 in U.S. small business energy costs annually.

Commercial Electricity Use

Bright Idea #22

Clean your equipment.

Bright Idea #23

Plug all leaks and seal all drafts.

Obviously, we’re talking about a little more than just energy here, but water is a major expense too. And a precious resource. Leaks and drafts cost money.

A little stripping, caulking, and plumbing maintenance can go a long way. Check all your sinks, toilets, pipes and irrigation systems to see if you’re losing water anywhere.

_

Search your building to see if there are any small drafts of air coming in. Be sure to properly seal drafty areas once found. Drafts, no matter how small, can result in increased heating and cooling costs throughout the year.

Investing in minor upkeep around your premises will help you reduce utility costs. Take a look at where you can limit waste.

Bright Idea #24

Only use energy when you need it.

Bright Idea #25

Invest in smart energy features.

A smart thermostat can do wonders to help regulate your business’s energy use each month. They let you program temperature settings for different spaces. Some systems can automatically adjust the temperature of a space based on whether or not people are in it. Many include diagnostic features to advise you when your equipment needs to be serviced.

Motion sensors activate lights on different parts of your property based on motion in the area. The same sensors turn the lights off when no one is in the space. Installing motion sensors will not only reduce your electricity expenses, but your light bulbs will last longer too.

Bright Savings Idea #26

Switch to LED lighting.

One of the biggest ways to reduce your electricity costs is to switch to energy-efficient lighting. Many small businesses have outdated lighting systems that consume too much energy and require high maintenance. By switching to LED lighting, you can reduce your monthly electricity bill by around 60%. Some lighting-as-a-service (LaaS) providers even offer zero upfront capital upgrades and free maintenance so you can start saving instantly.

Thousands of Dollars in Savings Right Above Your Head

While some businesses are counting pennies, the savviest ones are making investment decisions that will yield long term savings and value. Switching to LED lighting will not only lower your electricity costs. You will also:

-

Extend the life of your lights, ultimately reducing maintenance costs

-

Be more sustainable for the planet - reducing CO2, SO2 & NOX emissions

-

Create a safer and healthier physical environment - for customers and employees

-

Improve customer perception of your brand by demonstrating that you care about the environment.

Know exactly what monthly costs will be, enabling you to budget and manage cash flow.

Service providers typically offer ongoing maintenance and support throughout your subscription.

Reap the rewards of the product or service you're subscribing to before laying out the investment.

FES: An Energy Partner for Life

FES makes it easy for businesses to make smart energy choices that deliver exponential value.

We've partnered with thousands of small businesses across the country to:

- Save them money on energy costs

- Eliminate lighting maintenance expenses

- Improve health and safety for customers & employees

To date, FES has partnered with thousands of SMBs to:

Generate

$200M+

in energy savings

Install

500K+

energy efficient lights

Eliminate

68M+ lbs

of CO2 emissions/yr

Chat with an Energy Specialist

Get Paid to Switch Your Business to LED

About FES

Future Energy Solutions is on a mission to make it easy for businesses to make smart energy choices.

We design, deliver, install, and maintain LED lighting upgrades with zero capital cost up-front, making it easier and more cost effective than ever for businesses to switch to LED. We work closely with our customers to engineer custom lighting solutions perfectly tailored to individual business needs that deliver unrivaled savings.

For more practical tips on energy savings, post-pandemic recovery, and SMB operations, subscribe to our blog - the FES View.

.png?width=114&name=FES-Ebook-1%20(1).png)

Get Full Access

Tell us a little about your business to unlock complete access to the 26 Bright Business Savings Ideas eBook.